ReFi Tokenization

Relation

Tokenized carbon assets can be traded on a secondary market, ensuring a price mechanism for [[CO2]]. That enables for example asset managers and companies to incorporate carbon offsets directly into their offerings [4].

Tokenization can aid the voluntary carbon market in a range of ways, including by increasing liquidity and accessibility. Buyers and sellers can more easily trade credits, which can help to increase demand for credits and reduce volatility in the market. Tokenization can also help to reduce transaction costs and provide faster settlement times. The use of blockchain technology also increases transparency and tracking: it allows for the creation of a permanent, immutable record of all transactions, thereby enhancing the VCM’s credibility, as it provides a clear record of the history of each carbon credit. It can also help to reduce the risk of fraud and ensure that carbon credits are properly accounted for [11].

Carbon offset solution¶

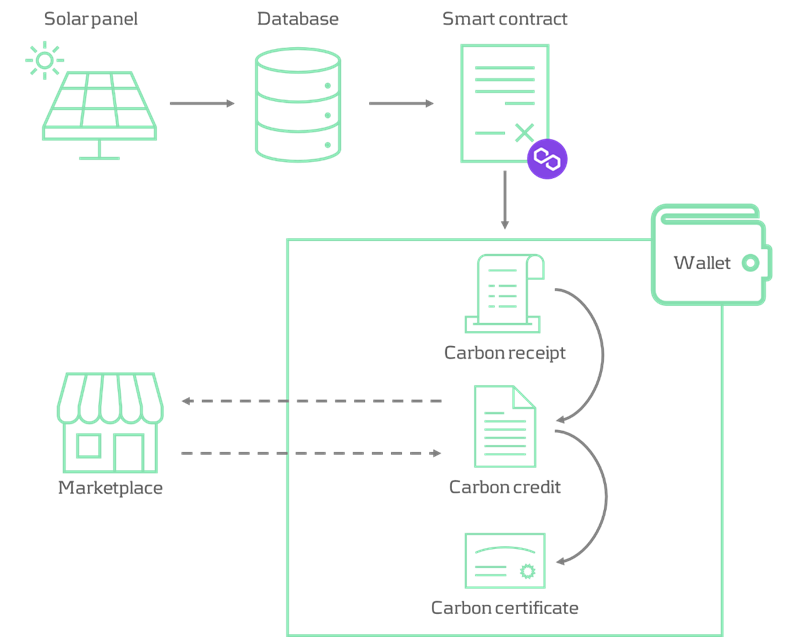

In the recent years, tokenization of (physical) assets and the creation of a digital version that is stored on the blockchain gained more interest. By utilizing blockchain technology, asset ownership can be tokenized, which enables fractional ownership, reduces intermediaries, and provides a secure and transparent ledger. This not only increases liquidity but also expands access to previously illiquid assets (like carbon offsets). The blockchain ledger allows for real-time settlement of transactions, increasing efficiency and reducing the risk of fraud. Additionally, tokens can be programmed to include certain rules and restrictions, such as limiting the number of tokens that can be issued or specifying how they can be traded, which can provide greater transparency and control over the asset [43].

How can carbon credit tokenization help the VCM [46]?¶

- Efficiency & Disintermediation

- Healthier and more open markets

- Liquid marketplaces

- Price discovery

- Eliminate double counting

- New sources of demand

- Better financing for developers

- Fractionalization

Benefits of Tokenized Carbon Credits¶

Increased Accessibility¶

Carbon markets become more accessible as tokenization removes geographical restrictions. Anyone across the world can purchase, trade, and retire tokenized carbon credits through digital platforms[44].

Fractional Ownership¶

Each credit can be split into smaller tokenized units, allowing individuals with limited budgets to offset their footprint[44].

Search "fractionalized" result 54 [45].

Tokenized carbon credits can be ‘fractionalized’ into units that are smaller than 1 metric tonne — like a currency. This benefits small-scale carbon projects, who could issue credits on smaller plots of land with significantly lower costs. For example, carbon credit development on a 5ha forest nets around like 30-50 tonnes of carbon credits per year, but measurements would cost around 50k USD. On the other hand, purchasing, selling and retiring carbon credits becomes more accessible. The retail and transportation industries also have a growing need for sub-tonne carbon credits, for example to offset exactly the right amount of carbon for the production of a single t-shirt or flight [46].

Enhanced Liquidity¶

Tokens can be seamlessly traded on decentralized exchanges, eliminating intermediaries and reducing costs[44].

Transparency¶

The blockchain provides an immutable record of a credit’s origins and ownership history, preventing double-counting or other fraud[44].

Automation¶

Smart contracts automate credit issuance, payments, transfers, and retirement, streamlining the process[44].

Price Discovery¶

Tokenization provides transparent pricing data, increasing market efficiency and competition[44].

How carbon credits are generated?¶

Everyone who is taking actions that remove or avoid emissions — for example conserving a forest — can apply to get carbon credits issued. For this, they’ll need to go to a standards body like Verra or Gold Standard. They then need to develop a detailed project design document (PDD) with estimates of carbon avoidance/reduction over time, and a solid business plan. The carbon standard screens the PDD, and an approved third-party auditor checks it as well — this party is called the validation and verification body (VVB). If the PDD meets the standard’s requirements, the project is validated for a certain number of carbon credits. Project development is, by then, in full swing. Once the actual emissions reduction/avoidance has occurred, a batch of carbon credits — each with its own serial number — is issued, with regular checks (so called performance verifications) conducted by the VVBs [46].

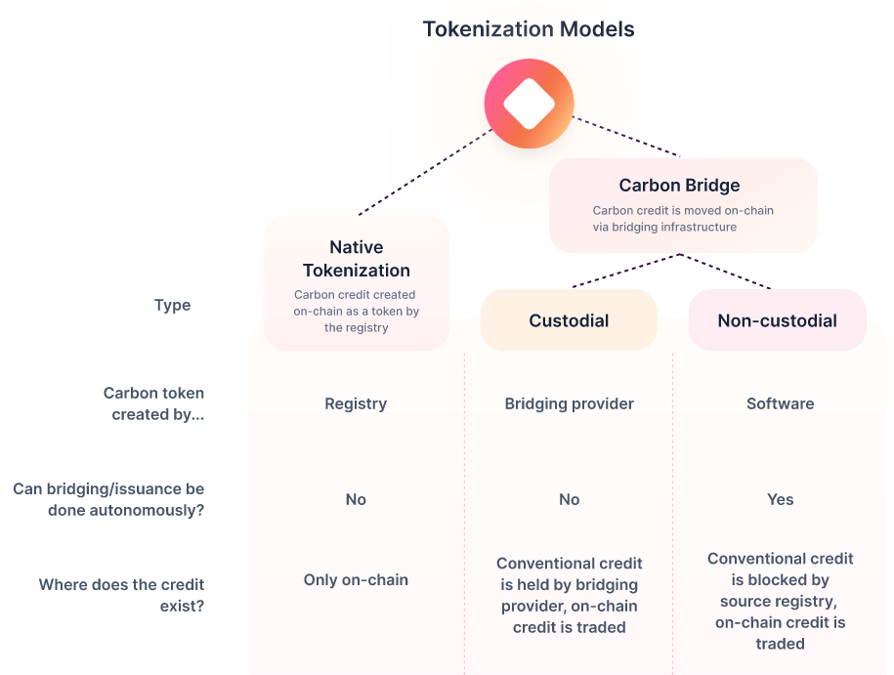

The project owner can now sell their credits to a carbon broker, or they can bridge them on-chain and sell them directly to interested end-users, pool them and use them in the ever-growing ecosystem of decentralized finance[46].

Average time elapsed before the developer can secure funding: 1-2 years [46].

Average time from project inception to credit issuance: 3-5 years [46].

Average cost to get the first project certification: $50-100k [46].