Natural climate solutions¶

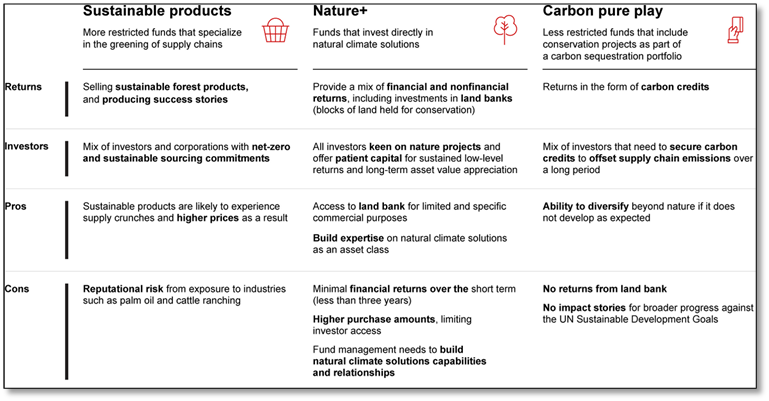

NCS are ways to sequester carbon through conservation, restoration, and improved land management of the world’s forests, grasslands, and wetlands. Three types of NCS funds are emerging with different sources for returns and target investors (see Figure below).

- Sustainable product funds: focus on greening supply chains for those with net-zero and sustainable sourcing commitments.

- Nature+ funds: invest directly in NCS to provide financial and nonfinancial returns for long-term investors.

- Carbon pure play funds: secure carbon credits from NCS investments within a broader carbon sequestration portfolio.

Offseting¶

Creating a biodiversity [[offset]] market requires 3 things [24]:

- New legislation introducing mandatory restoration targets, in order to create the demand

- A policy framework that considers that restoration compensates for destruction taking place elsewhere and at a different time;

- A market framework allowing for the free trading of offset permits.

Let’s take the example of a company wanting to build an airport in the South of Spain in an area that is a habitat for flamingos. With biodiversity offsetting, the law would allow the construction of the airport, provided that the company tries to avoid or minimize the impact on biodiversity. Any residual impact must be offset by recreating a habitat for flamingos within a radius of X kilometres.

in reality, most of the time we are unable to recreate comprehensively all the ecosystem functions destroyed.

A few years ago, the European Commission proposed an extreme version of biodiversity offsetting called Habitat Banking: The European Commission commissioned a study on [[Habitat_Banking]] in 2010, tried to introduce it in the Habitats and Birds directives in 2014 during a fitness test, but ulti- mately backed down due to overwhelming public outcry [24].

Putting a price on nature¶

Natural capital is a very specific framing of nature that has emerged over the past decades: nature and ecosystems are conceptualised as a list of services that benefit humans, such as pollination, flood prevention etc… All the ecosystemic functions and species that do not benefit humans are implicitly ignored: for instance, plants that are not edible nor considered pretty, species that are considered by some as ‘pests’. As importantly, ecosystem services require beneficiaries to be valued: the flood prevention service provided by a forest will be valued at zero if no humans live nearby and can benefit from this service for example [24].

There are two main methods to put a price on nature [24]:

-

Revealed preference methods: Prices are inferred from the prices of goods and services traded in markets. For example, let’s imagine two identical flats where only the second one has a view over Central Park. The first one sold for $1 million, whereas the second one sold for $1,5 million.This method will consider that the price difference represents the value of a view over Central Park and a meaningful factor in determining the value of Central Park.

-

Stated preference methods: these methods are mostly based on surveys. People are being asked how much they are willing to pay for a natural site not to be destroyed, or inversely how much they want to receive in exchange for its destruction. As an example, a 1980 survey asked residents of Chicago how much they would be willing to pay to preserve the visibility over the Grand Canyon. The average price was $90. A similar survey was conducted a year and a half later, and the average answer came this time at $169.

What Do We Mean by NaaAC?¶

We’re referring to investments in land- and water-based projects or businesses that are pursuing financial returns alongside ecological and social impacts. These impacts are achieved through nature conservation, ecosystem regeneration, regenerative uses of productive landscapes, and reductions in the drivers of biodiversity loss. These projects are monetized through the sale of high-quality carbon offsets, biodiversity credits, ecotourism, endangered species credits, lumber, food, consumer products made with local ingredients, and more. The markets are varied, but the theme is consistent [23].

As I mentioned in my last article, we anticipate the market to place a strong emphasis on productive land and seascapes, as these areas require 73 percent of the estimated $830 billion in annual funding for the transition to regenerative farming, and fisheries. Many projects will focus on sequestering carbon, improving measurement of biodiversity indicators, or addressing other climate and biodiversity-related outcomes [23].

How Might Nature Qualify as an Asset Class?¶

If you were making a checklist of criteria in the “What is an Asset Class” section, you would hopefully come away with something like: uniqueness, size, liquidity, and breadth. Let’s explore how those criteria map to the nature space: Uniqueness, Size, and Liquidity[23].

Uniqueness¶

Bottom Line: Nature projects should help diversify even sophisticated investor portfolios[23].

Size¶

Bottom Line: The opportunity for directing capital toward regenerative projects and land stewards should continue to develop as all participants in the sector mature[23].

Liquidity¶

Bottom Line: This is a work in progress. Several means to monetize natural capital and otherwise provide transfers of project ownership are already in development[23].

Breadth¶

Bottom Line: Investors can already build sufficiently broad allocations within their Nature sleeve [23].